By Industry |

By Type of Investment |

|

|

|

As filed with the Securities and Exchange Commission on May 9, 2011

Securities Act File No. 333-168280

and 333-172503

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 ý

Pre-Effective Amendment No. 3 ý

Post-Effective Amendment No. o

New Mountain Finance Corporation

New Mountain Guardian (Leveraged), L.L.C.

(Exact name of registrant as specified in charter)

787 7th Avenue, 48th Floor

New York, NY 10019

(212) 720-0300

(Address and telephone number,

including area code, of principal executive offices)

Robert A. Hamwee

Chief Executive Officer

New Mountain Finance Corporation

787 7th Avenue, 48th Floor

New York, NY 10019

(Name and address of agent for service)

COPIES TO:

| Stuart H. Gelfond, Esq. Jessica Forbes, Esq. Vasiliki B.Tsaganos, Esq. Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, NY 10004 Tel: (212) 859-8000 Fax: (212) 859-4000 |

Steven B. Boehm, Esq. John J. Mahon, Esq. Sutherland Asbill & Brennan LLP 1275 Pennsylvania Avenue, NW Washington, DC 20004 Tel: (202) 383-0100 Fax: (202) 637-3593 |

Approximate

date of proposed public offering: As soon as practicable after the effective date of this

Registration Statement.

If any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933, other than securities offered in connection with a dividend reinvestment plan, check the following box. o

It is proposed that this filing will become effective (check appropriate box):

o when declared effective pursuant to Section 8(c).

CALCULATION OF REGISTRATION FEE UNDER THE SECURITIES ACT OF 1933

|

||||

| Title of Securities Being Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||

|---|---|---|---|---|

Common Stock, $0.01 par value per share(4) |

$200,000,000 | $14,260 | ||

|

||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 9, 2011

8,285,172 Shares

New Mountain Finance Corporation

Common Stock

This is an initial public offering of shares of common stock of New Mountain Finance Corporation. Following this offering, we will be a holding company with no direct operations of our own, and our only business and sole asset will be our ownership of common membership units of New Mountain Finance Holdings, L.L.C., or the Operating Company. The Operating Company will be an externally managed business development company managed by New Mountain Finance Advisers BDC, L.L.C. and will be the operating company for our business. New Mountain Finance Corporation and the Operating Company each intend to elect to be treated as business development companies under the Investment Company Act of 1940 prior to the completion of this offering.

Our investment objective is to generate current income and capital appreciation through investments in debt securities at all levels of the capital structure, including first and second lien debt, unsecured notes and mezzanine securities.

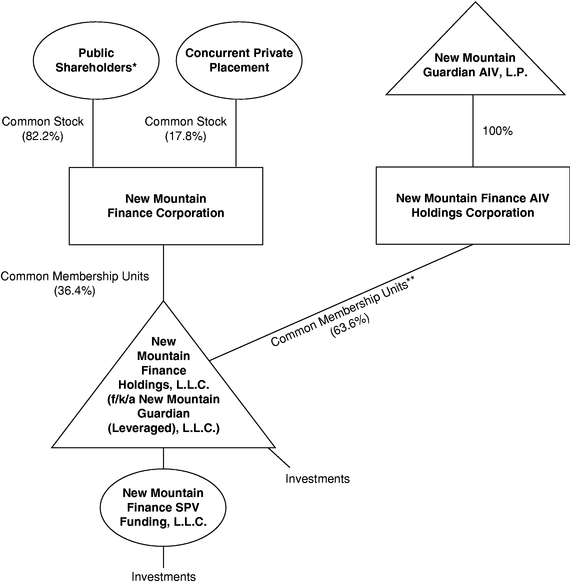

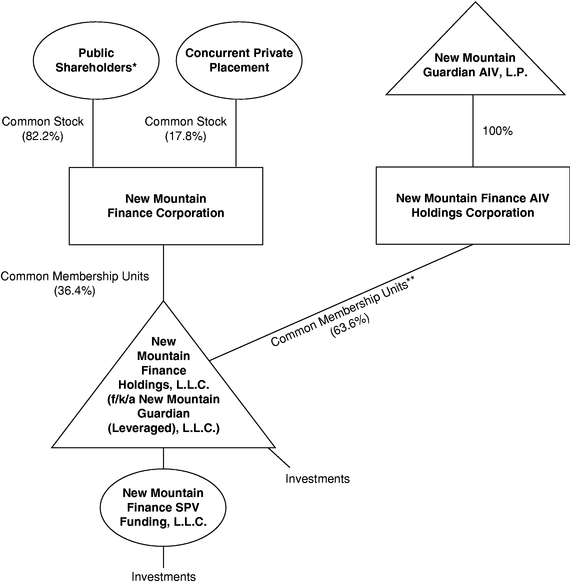

Following the completion of this offering, we will own approximately 36.4% of the common membership units of the Operating Company and affiliates of New Mountain Capital, L.L.C. will own approximately 63.6% of the common membership units of the Operating Company and approximately 28.6% of our outstanding common stock, assuming no exercise of the underwriters' option to purchase additional shares.

All of the 8,285,172 shares of common stock offered in this offering are being sold by us. After giving effect to the formation transactions, this offering and the concurrent private placement to certain individuals affiliated with New Mountain Capital, L.L.C., the adjusted unaudited net asset value of our common stock on March 31, 2011 was approximately $14.14 per share on a fully diluted basis. See "Recent Developments — Net Asset Value." Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $14.00 and $15.00. Our common stock has been approved for listing on the New York Stock Exchange under the symbol "NMFC".

Investing in our common stock is highly speculative and involves a high degree of risk. See "Risk Factors" beginning on page 27. This is an initial public offering, and there is no prior public market for our shares of common stock. Shares of closed-end investment companies, including business development companies, frequently trade at a discount to their net asset value. If our shares of common stock trade at a discount to net asset value, it may increase the risk of loss for purchasers in this offering. Assuming an initial public offering price of $14.50 per share (the mid-point of the range set forth on this cover), purchasers in this offering will experience immediate dilution of approximately $0.36 per share on a fully diluted basis based on our adjusted unaudited net asset value as of March 31, 2011. See "Dilution" on page 83.

This prospectus contains important information about us that a prospective investor should know before investing in our common stock. Please read this prospectus before investing and keep it for future reference. Upon completion of this offering, we will file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission. This information will be available free of charge by contacting us at 787 7th Avenue, 48th Floor, New York, NY 10019 or by telephone at (212) 720-0300 or on our website at www.newmountainfinancecorp.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider that information to be part of this prospectus. The Securities and Exchange Commission also maintains a website at www.sec.gov that contains such information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Share

|

Total

|

|||||

|---|---|---|---|---|---|---|---|

Public Offering Price |

$ | $ | |||||

Sales Load (Underwriting Discounts and Commissions) |

$ | $ | |||||

Proceeds to us(1)(2) |

$ | $ | |||||

Joint-Lead Bookrunners

Goldman, Sachs & Co. |

Wells Fargo Securities | Morgan Stanley |

Co-Lead Managers

Stifel Nicolaus Weisel |

RBC Capital Markets |

Co-Managers

| Baird | BB&T Capital Markets A division of Scott & Stringfellow, LLC |

Janney Montgomery Scott |

Prospectus dated , 2011.

You should rely on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information or to make representations as to matters not stated in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell, and seeking offers to buy, securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. To the extent required by law, we will amend or supplement the information contained in this prospectus to reflect any material changes to such information subsequent to the date of the prospectus and prior to the completion of the offering pursuant to this prospectus.

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider. You should read carefully the more detailed information set forth under "Risk Factors" and the other information included in this prospectus.

In this prospectus, unless the context otherwise requires, references to:

In connection with this offering, a series of formation transactions will be undertaken such that, prior to the completion of this offering, the Operating Company will own all of the operations of the Predecessor Entities existing immediately prior to the formation transactions, including all of the

1

assets and liabilities related to such operations. Except where the context suggests otherwise, references to the "Company", "we", "us" and "our" refer to New Mountain Finance together with the Operating Company, including the combined operations of the Predecessor Entities prior to and after the completion of the formation transactions. Concurrently with the closing of this offering, certain executives and employees of, and other individuals affiliated with, New Mountain will buy 2,059,655 shares of New Mountain Finance common stock in a separate private placement at the initial public offering price per share. We refer to this transaction as the concurrent private placement.

The Company

New Mountain Finance will be a holding company with no direct operations of its own, and its only business and sole asset will be its ownership of common membership units of the Operating Company. The Operating Company will be an externally managed business development company, which will own all of the operations of the Predecessor Entities existing immediately prior to the formation transactions, including all of the assets and liabilities related to such operations. Following the completion of this offering, New Mountain Finance will own approximately 36.4%, and Guardian AIV will indirectly own through AIV Holdings approximately 63.6%, of the common membership units of the Operating Company, assuming no exercise of the underwriters' option to purchase additional shares.

Our investment objective is to generate current income and capital appreciation through investments in debt securities at all levels of the capital structure, including first and second lien debt, unsecured notes and mezzanine securities, which we refer to as "Target Securities". We expect to primarily target loans to, and invest in, U.S. middle market businesses, a market segment we believe will continue to be underserved by other lenders. We define middle market businesses as those businesses with annual earnings before interest, taxes, depreciation, and amortization, or "EBITDA", between $20 million and $200 million. We expect to make investments through both primary originations and open-market secondary purchases. We intend to invest primarily in debt securities that are rated below investment grade and have unlevered yields of 10% to 15%.(1) However, there can be no assurance that targeted returns will be achieved on our investments as they are subject to risks, uncertainties and other factors, some of which are beyond our control, and which may lead to non-payment of interest and principal. See "Risk Factors — Risks Relating to Our Investments". We intend our investments to typically have maturities of between five and ten years and generally range in size between $10 million and $50 million. This investment size may vary proportionately as the size of the Operating Company's capital base changes. We believe our focus on investment opportunities with contractual current interest payments should allow us to provide New Mountain Finance stockholders with consistent dividend distributions and attractive risk adjusted total returns.

Our investments may also include equity interests such as preferred stock, common stock, warrants or options received in connection with our debt investments. In some cases, we may invest directly in the equity of private companies. From time to time, we may also invest through the Operating Company in other types of investments, which are not our primary focus, to enhance the overall return of the portfolio. These investments may include, but are not limited to, distressed debt and related opportunities.

The Operating Company will be externally managed by the Investment Adviser, a wholly-owned subsidiary of New Mountain. The investment strategy, developed by our Investment Adviser, is to invest through the Operating Company primarily in the debt of defensive growth companies,

2

which are defined as generally exhibiting the following characteristics: (i) sustainable secular growth drivers, (ii) high barriers to competitive entry, (iii) high free cash flow after capital expenditure and working capital needs, (iv) high returns on assets and (v) opportunities for niche market dominance. The Investment Adviser, through its relationship with New Mountain, already has access to proprietary research and operating insights into many of the companies and industries that meet this template. We believe the presence within New Mountain of numerous former CEOs and other senior operating executives, and their active involvement in our underwriting process, combined with New Mountain's experience as a majority stockholder owning and directing a wide range of businesses and overseeing operating companies in the same or related industries, is a key differentiator for us versus typical debt investment vehicles.

Since the commencement of the Predecessor Entities' operations in October 2008 through December 31, 2010, approximately $664.1 million has been invested in 61 companies and total realized and unrealized gains and investment income of approximately $193.6 million have been earned with an average holding period of eight months.

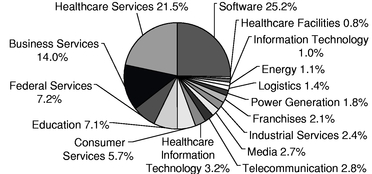

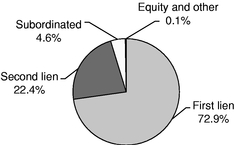

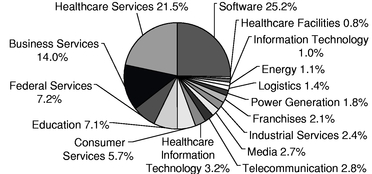

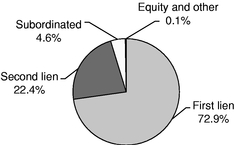

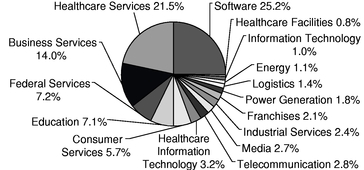

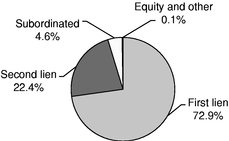

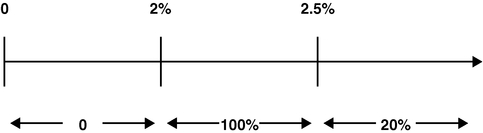

The following charts summarize our portfolio mix by industry and type based on the fair value(1) of our investments as of December 31, 2010.

By Industry |

By Type of Investment |

|

|

|

As of December 31, 2010, our portfolio had a fair value of approximately $441.1 million in 43 portfolio companies and had a weighted average Yield to Maturity of approximately 12.5%. For purposes of this prospectus, references to "Yield to Maturity" assume that the investments in our portfolio as of a certain date, the "Portfolio Date", are purchased at fair value on that date and held until their respective maturities with no prepayments or losses and are exited at par at maturity. These references also assume that unfunded revolvers remain undrawn. Interest income is assumed to be received quarterly for all debt securities. For floating rate debt securities, the interest rate is calculated by adding the spread to the projected three-month LIBOR at each respective quarter, which is determined based on the forward three-month LIBOR curve per Bloomberg as of the Portfolio Date. This calculation excludes the impact of existing leverage, except for the non-recourse debt of SLF. SLF is treated as a fully levered asset of the Operating Company, with SLF's net asset value being included for yield calculation purposes. As of December 31, 2010, our portfolio had a weighted average Unadjusted Yield to Maturity of 10.6%. For purposes of this prospectus, references to "Unadjusted Yield to Maturity" have the same assumptions as Yield to Maturity, except that SLF is not treated as a fully levered asset of the Operating Company, and the assets of SLF are consolidated into the Operating Company. The actual yield to maturity may be

3

higher or lower due to the future selection of LIBOR contracts by the individual companies in our portfolio or other factors. Since inception, the Predecessor Entities have not experienced any payment defaults or credit losses on our portfolio investments.

Prior to the completion of this offering, the Operating Company will become a party to a secured credit agreement with Wells Fargo Bank, N.A. (the "Credit Facility"), which amends and restates the $120 million credit facility of the Predecessor Entities existing prior to this offering (the "Predecessor Credit Facility"). The Credit Facility, which matures on October 21, 2015, provides for potential borrowings up to $160 million. Unlike many credit facilities for business development companies, the amount available under the Credit Facility is not subject to reduction as a result of mark to market fluctuations in our portfolio investments. Under the terms of the Credit Facility, the Operating Company is permitted to borrow up to 45.0% or 25.0% of the purchase price of pledged first lien debt securities or non-first lien debt securities, respectively, subject to approval by Wells Fargo Bank, N.A. and borrowings currently bear interest at an annual rate of one month LIBOR plus a margin of 3.0%. As of December 31, 2010, $59.7 million was outstanding under the Predecessor Credit Facility. Borrowings have been used under the Predecessor Credit Facility to purchase the senior secured loans and bonds that constitute a portion of our current portfolio.

The Operating Company expects to continue to finance our investments using both debt and equity, including proceeds from equity issued by New Mountain Finance, which will be contributed to the Operating Company.

On October 7, 2010, the Predecessor Entities formed SLF, an entity that invests in first lien debt securities. SLF is a party to a secured revolving credit facility (the "SLF Credit Facility") with a maximum availability of $150 million and with the Operating Company as the Collateral Administrator, Wells Fargo Securities, LLC as the Administrative Agent and Wells Fargo Bank, National Association, as the Collateral Custodian. The debt under the SLF Credit Facility is non-recourse to the Operating Company and has a maturity date of October 27, 2015. Under the terms of this credit facility, SLF is permitted to borrow up to 67.0% of the purchase price of pledged debt securities subject to approval by Wells Fargo Bank, N.A. and borrowings currently bear interest at an annual rate of LIBOR plus a margin of 2.25%. As of December 31, 2010, $56.9 million was outstanding under the SLF Credit Facility. SLF is consolidated on the financial statements of the Predecessor Entities.

For a detailed discussion of the Credit Facility, the Predecessor Credit Facility and the SLF Credit Facility, see "Management's Discussion and Analysis of Financial Conditions and Results of Operations — Liquidity and Capital Resources — Credit Facilities".

New Mountain

New Mountain manages private equity, public equity and debt investments with aggregate assets under management (which includes amounts committed, not all of which have been drawn down and invested to date) totaling more than $9.0 billion as of December 31, 2010.

Guardian Leveraged was formed as a subsidiary of Guardian AIV by New Mountain in October 2008. Guardian AIV was formed through an allocation of approximately $300 million of the $5.1 billion of commitments supporting New Mountain Partners III, L.P., or "Fund III", a private equity fund managed by New Mountain, and in February 2009 New Mountain formed a co-investment vehicle, Guardian Partners, comprising $20.4 million of commitments. See "Business — New Mountain" for more information on New Mountain.

4

The Investment Adviser

The Investment Adviser, a wholly owned subsidiary of New Mountain, will manage the Operating Company's day-to-day operations and provide it with investment advisory and management services. In particular, the Investment Adviser will be responsible for identifying attractive investment opportunities, conducting research and due diligence on prospective investments, structuring our investments and monitoring and servicing our investments. Neither New Mountain Finance nor the Operating Company currently has or will have any employees. As of December 31, 2010, the Investment Adviser was supported by approximately 86 New Mountain staff members, including approximately 53 investment professionals (including 14 managing directors and 13 senior advisers) as well as 14 finance and operational professionals. These individuals will allocate a portion of their time in support of the Investment Adviser based on their particular expertise as it relates to a potential investment opportunity.

The Investment Adviser has an investment committee comprised of five members, including Steven Klinsky, Robert Hamwee, Adam Collins, Doug Londal and Alok Singh. The investment committee will be responsible for approving all of our investments above $5 million. The investment committee will also monitor investments in our portfolio and approve all asset dispositions above $5 million. Investments and dispositions below $5 million may be approved by the Operating Company's Chief Executive Officer. These approval thresholds may change over time. We expect to benefit from the extensive and varied relevant experience of the investment professionals serving on the Investment Adviser's investment committee, which includes expertise in private equity, primary and secondary leveraged credit, private mezzanine finance and distressed debt.

Recent Developments(1)

Net Asset Value

New Mountain Finance's March 31, 2011 unaudited net asset value per share is $14.14 on an adjusted and fully diluted basis, reflecting contributions from our investors in the Predecessor Entities received after March 31, 2011, the consummation of the formation transactions, the initial public offering and concurrent private placement (assuming no exercise of the underwriters' option to purchase additional shares), and the temporary repayment of indebtedness. See "The Offering." Upon completion of this offering and the concurrent private placement, New Mountain Finance will own 36.4% of the Operating Company (assuming no exercise of the underwriters' option to purchase additional shares). On April 21, 2011, the Operating Company's board of directors, of which a majority of the board members are independent directors, approved the fair value of our portfolio investments as of March 31, 2011 in accordance with the Operating Company's valuation policy to be $460.0 million and determined the Operating Company's unaudited net asset value as of March 31, 2011 to be $313.5 million, which is adjusted to include $23.3 million of contributions received from our investors in the Predecessor Entities after March 31, 2011. This will result in the issuance of 20,221,938 common membership units of the Operating Company (which are exchangeable on a one-for-one basis into shares of New Mountain Finance common stock) to AIV Holdings and 1,252,964 shares of New Mountain Finance common stock to Guardian Partners for their respective ownership interests in the Predecessor Entities. The Operating Company's March 31, 2011 adjusted net asset value is based on the board-approved fair value of our portfolio investments as well as other factors, including investment income earned on the portfolio since December 31, 2010. The 29.6% change in net asset value from December 31, 2010 was primarily due to additional purchases of $87.3 million, sales of $25.9 million, net contributions received since December 31, 2010 and the Operating Company's retained investment income. The March 31, 2011 adjusted unaudited net asset value is comprised of an estimated $523.0 million in assets (36.2%

5

from SLF) and an estimated $209.5 million in liabilities (52.8% from SLF). The estimated assets include cash of $27.2 million and contributions received from investors after March 31, 2011. The estimated liabilities include $171.8 million of borrowings under the Predecessor Credit Facility and SLF Credit Facility, and a $27.6 million payable for unsettled securities purchased. See "Determination of Net Asset Value". The adjusted unaudited net asset value per share as of March 31, 2011 will be different than our actual net asset value for March 31, 2011, primarily due to the contributions from the investors in our Predecessor Entities received after March 31, 2011.

Distributions/Contributions

For the period from March 31, 2011, to April 15, 2011, Guardian AIV and New Mountain Guardian Partners, L.P. received aggregate contributions of $23.3 million from our investors in the Predecessor Entities and made no distributions to the partners of Guardian AIV and New Mountain Guardian Partners, L.P.

New Mountain Finance's first quarterly distribution, which will be payable for the second quarter of 2011, is expected to be between $0.20 and $0.25 per share. The amount of the dividend will be proportionately reduced to reflect the number of days remaining in the quarter after the completion of this offering. The actual amount of such distribution, if any, remains subject to approval by New Mountain Finance's board of directors, and there can be no assurance that any distribution paid will fall within such range. In addition, because New Mountain Finance will be a holding company, it will only be able to pay distributions on its common stock from distributions received from the Operating Company. The Operating Company intends to make distributions to its members that will be sufficient to enable New Mountain Finance to pay quarterly distributions to its stockholders and to obtain and maintain its status as a regulated investment company, or "RIC", under Subchapter M of the Internal Revenue Code of 1986, as amended (the "Code"). New Mountain Finance intends to distribute to its stockholders substantially all of its annual taxable income, except that it may retain certain net capital gains for reinvestment in common membership units of the Operating Company.

Recent Portfolio Activity

After giving effect to the Predecessor Entities' purchases and sales between January 1, 2011 and March 31, 2011, our pro forma weighted average Yield to Maturity as of March 31, 2011 would have been 12.6% consisting of: (1) 9.8% cash interest based on LIBOR as of March 31, 2011, (2) an additional 0.6% representing the impact of using the forward three-month LIBOR curve on an asset by asset basis, (3) 1.0% current payment-in-kind ("PIK") interest and (4) 1.2% accretion of market discount. Our pro forma weighted average Unadjusted Yield to Maturity as of March 31, 2011 would have been 10.5%. For a list of the Predecessor Entities' and SLF's purchases and sales between January 1, 2011 and March 31, 2011, see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Recent Developments — Recent Portfolio Activity".

6

We believe that we have the following competitive advantages over other capital providers to middle market companies:

Proven and Differentiated Investment Style With Areas of Deep Industry Knowledge

In making its investment decisions, the Investment Adviser intends to apply New Mountain's long-standing, consistent investment approach that has been in place since its founding more than 10 years ago. We expect to focus on companies in less well followed defensive growth niches of the middle market space where we believe few debt funds have built equivalent research and operational size and scale.

We expect to benefit directly from New Mountain's private equity investment strategy that seeks to identify attractive investment sectors from the top down and then works to become a well positioned investor in these sectors. New Mountain focuses on companies and end markets with sustainable strengths in all economic cycles, particularly ones that are defensive in nature, that are non-cyclical and can maintain pricing power in the midst of a recessionary and/or inflationary environment. New Mountain focuses on companies within sectors in which it has significant expertise (examples include federal services, software, education, niche healthcare, business services, energy and logistics) while typically avoiding investments in companies with end markets that are highly cyclical, face secular headwinds, are overly-dependent on consumer demand or are commodity-like in nature.

In making its investment decisions, the Investment Adviser has adopted the approach of New Mountain, which is based on three primary investment principles:

Experienced Management Team and Established Platform

The Investment Adviser's team members have extensive experience in the leveraged lending space. Steven Klinsky, New Mountain's Founder and Chief Executive Officer, was a general partner of the manager of debt and equity funds, totaling multiple billions of dollars at Forstmann Little & Co. in the 1980s and 1990s. He was also a co-founder of Goldman, Sachs & Co.'s Leverage Buyout Group in the period from 1981 to 1984. Robert Hamwee, Managing Director of New Mountain, was formerly President of GSC Group, Inc., or "GSC", where he was the portfolio manager of GSC's distressed debt funds and led the development of GSC's CLOs. Doug Londal, Managing Director of New Mountain, was previously co-head of Goldman, Sachs & Co.'s U.S. mezzanine debt team. Alok Singh, Managing Director of New Mountain, has extensive experience structuring debt products as a long-time partner at Bankers Trust Company.

Many of the debt investments that we have made to date have been in the same companies with which New Mountain has already conducted months of intensive acquisition due diligence related to potential private equity investments. We believe that private equity underwriting due diligence is usually more robust than typical due diligence for loan underwriting. In its underwriting of debt investments, the Investment Adviser is able to utilize the research and hands-on operating experience that New Mountain's private equity underwriting teams possess regarding the individual companies and industries. Business and industry due diligence is led by a team of investment

7

professionals of the Investment Adviser that generally consists of three to seven individuals, typically based on their relevant company and/or industry specific knowledge. Additionally, the Investment Adviser is also able to utilize its relationships with operating management teams and other private equity sponsors. We believe this will differentiate us from many of our competitors.

Significant Sourcing Capabilities and Relationships

We believe the Investment Adviser's ability to source attractive investment opportunities is greatly aided by both New Mountain's historical and current reviews of private equity opportunities in the business segments we target. To date, a significant majority of the investments we have made through the Operating Company are in the debt of companies and industry sectors that were first identified and reviewed in connection with New Mountain's private equity efforts, and the majority of our current pipeline reflects this as well. Furthermore, the Investment Adviser's investment professionals have deep and longstanding relationships in both the private equity sponsor community and the lending/agenting community which they have and will continue to utilize to generate investment opportunities.

Risk Management through Various Cycles

New Mountain has emphasized tight control of risk since its inception and long before the recent global financial distress began. To date, New Mountain has never experienced a bankruptcy of any of its portfolio companies in its private equity efforts or efforts with respect to Predecessor Entities' business. The Investment Adviser will seek to emphasize tight control of risk with our investments in several important ways, consistent with New Mountain's historical approach. In particular, the Investment Adviser intends to:

Access to Non Mark to Market, Seasoned Leverage Facility

The Operating Company's and the SLF's amounts available under their existing credit facilities are not subject to reduction as a result of mark to market fluctuations in their portfolio investments. For a detailed discussion of the Credit Facility and the SLF Credit Facility, see "Management's Discussion and Analysis of Financial Conditions and Results of Operations — Liquidity and Capital Resources".

We believe that the size of the market for Target Securities, coupled with the demands of middle market companies for flexible sources of capital at competitive terms and rates, create an attractive investment environment for us.

8

9

New Mountain Finance was incorporated in Delaware on June 29, 2010 as New Mountain Guardian Corporation, and it changed its name to New Mountain Finance Corporation on February 25, 2011. Prior to this offering, it did not engage in any activities, except in preparation for this offering, and it had no operations or assets. New Mountain currently owns the only issued and outstanding share of common stock of New Mountain Finance.

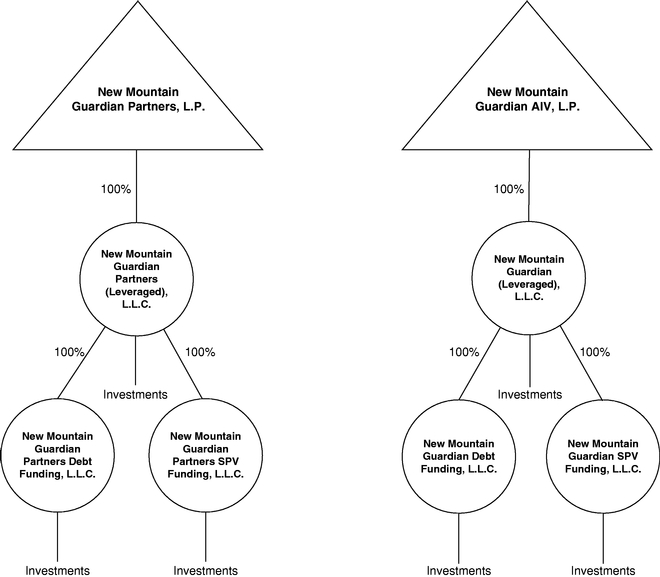

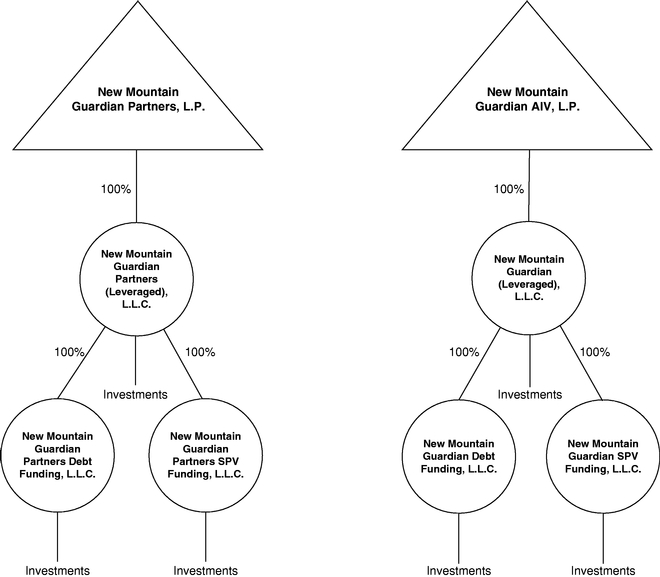

The simplified diagram below depicts our current organizational structure prior to the structuring transactions contemplated by this offering:

In connection with this offering, a series of formation transactions will be undertaken such that, prior to the completion of this offering, the Operating Company will own all of the operations of the Predecessor Entities existing immediately prior to the formation transactions, including all of the assets and liabilities related to such operations. As a result of these transactions, Guardian AIV will indirectly own through its wholly-owned subsidiary, AIV Holdings, common membership units of the Operating Company. New Mountain Finance will enter into a joinder agreement with respect to the amended and restated limited liability company agreement of the Operating Company, pursuant to which New Mountain Finance will be admitted as a member of the Operating Company and will

10

agree to acquire from the Operating Company, with the gross proceeds of this offering and the concurrent private placement, common membership units of the Operating Company (the number of common membership units will equal the number of shares of New Mountain Finance's common stock sold in this offering and the concurrent private placement) in connection with the completion of this offering. The per unit purchase price New Mountain Finance will pay for the common membership units acquired pursuant to a joinder agreement to the amended and restated limited liability company agreement of the Operating Company will be equal to the per share offering price at which New Mountain Finance's common stock is sold pursuant to this offering. After the completion of this offering, New Mountain Finance will be a holding company with no direct operations of its own, and its only business and sole asset will be its ownership of common membership units of the Operating Company. See "Formation Transactions and Related Agreements".

At the closing of this offering New Mountain Finance will own approximately 36.4%, and Guardian AIV will indirectly own through AIV Holdings approximately 63.6%, of the common membership units of the Operating Company, assuming no exercise of the underwriters' option to purchase additional shares. If the underwriters exercise this option to purchase additional shares of New Mountain Finance's common stock, pursuant to the amended and restated limited liability company agreement of the Operating Company, or the "LLC Agreement", immediately thereafter New Mountain Finance will acquire from the Operating Company an equivalent number of additional common membership units in exchange for the gross proceeds New Mountain Finance receives upon exercise of the option.

The Operating Company has calculated the unaudited, adjusted net asset value of the Operating Company, the "cutoff NAV", as of March 31, 2011, the "cutoff date". The cutoff NAV was determined and approved by the Operating Company's board of directors and was calculated consistent with its policies for determining net asset value. See "Determination of Net Asset Value". Consistent with these policies, an independent third party valuation firm will provide the Operating Company with annual valuation assistance with respect to investments for which market quotations are not available. The Operating Company accrued interest income and related expenses as of the cutoff date. The cutoff NAV calculation was comprised of all the investments at fair value plus any interest income accruals, less any expense accruals through the cutoff date.

In addition, certain executives and employees of, and other individuals affiliated with, New Mountain will purchase 2,059,655 shares of New Mountain Finance's common stock in connection with the consummation of this offering in the concurrent private placement. These shares will be sold at the same offering price paid by investors in this offering, in a private placement transaction exempt from registration under the Securities Act of 1933, as amended, or the Securities Act.

11

The simplified diagram below depicts our summarized organizational structure immediately after the transactions described in this prospectus (assuming no exercise of the underwriters' option to purchase additional shares):

Operating and Regulatory Structure

After the completion of this offering, New Mountain Finance will be a closed-end, non-diversified management investment company that has elected to be treated as a business development company under the 1940 Act and will use leverage but will be required to maintain an asset coverage ratio, as defined in the 1940 Act, of at least 200%. New Mountain Finance will have no material long-term liabilities itself and its only business and sole asset will be its ownership of common membership units of the Operating Company. As a result, New Mountain Finance will look to the Operating Company's assets for purposes of satisfying the requirements under the 1940 Act

12

otherwise applicable to New Mountain Finance. The Operating Company will be an externally managed, closed-end non-diversified management investment company that has elected to be treated as a business development company under the 1940 Act. As a business development company, the Operating Company will also be required to maintain an asset coverage ratio, as defined in the 1940 Act, of at least 200%. See "Regulation". The Operating Company and the SLF have long term liabilities related to their credit facilities.

New Mountain Finance intends to elect to be treated, and intends to qualify annually, as a RIC under Subchapter M of the Code, commencing with its taxable year ending on December 31, 2011. See "Material Federal Income Tax Considerations". As a RIC, New Mountain Finance generally will not have to pay corporate-level federal income taxes on any net ordinary income or capital gains that it timely distributes to its stockholders as dividends if it meets certain source-of-income, distribution and asset diversification requirements. The Operating Company intends to make distributions to its members that will be sufficient to enable New Mountain Finance to pay quarterly distributions to its stockholders and to obtain and maintain its status as a RIC. New Mountain Finance intends to distribute to its stockholders substantially all of its annual taxable income, except that it may retain certain net capital gains for reinvestment in common membership units of the Operating Company.

An investment in New Mountain Finance's common stock involves risk, including the risk of leverage and the risk that our operating policies and strategies may change without prior notice to New Mountain Finance stockholders or prior stockholder approval. See "Risk Factors" and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of New Mountain Finance's common stock. The value of the Operating Company's assets, as well as the market price of New Mountain Finance's shares, will fluctuate. Our investments may be risky, and you may lose all or part of your investment in New Mountain Finance. Investing in New Mountain Finance involves other risks, including the following:

13

Company's ability to issue senior securities or borrow for investment purposes, any or all of which could have a negative effect on our investment objectives and strategies;

Our administrative and executive offices are located at 787 7th Avenue, 48th Floor, New York, New York 10019, and our telephone number is (212) 720-0300. We expect to establish a website at http://www.newmountainfinancecorp.com upon completion of this offering. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider information contained on our website to be part of this prospectus.

Presentation of Historical Financial Information and Market Data

Historical Financial Information

Unless otherwise indicated, historical references contained in this prospectus in "Selected Financial and Other Data", "Capitalization", "Management's Discussion and Analysis of Financial

14

Condition and Results of Operations", "Senior Securities" and "Portfolio Companies" relate to the Operating Company, which will be New Mountain Finance's sole investment following the completion of this offering. The combined financial statements of New Mountain Finance Holdings, L.L.C., formerly known as New Mountain Guardian (Leveraged), L.L.C., and New Mountain Guardian Partners, L.P. are the Operating Company's historical combined financial statements.

Market Data

Statistical and market data used in this prospectus has been obtained from governmental and independent industry sources and publications. We have not independently verified the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the data. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements contained in this prospectus. See "Special Note Regarding Forward-Looking Statements".

15

Common Stock Offered by New Mountain Finance |

8,285,172 shares, excluding 1,242,776 shares of common stock issuable pursuant to the option to purchase additional shares granted to the underwriters. | |

Concurrent Private Placement |

Concurrently with the closing of this offering, New Mountain Finance will sell 2,059,655 shares of its common stock to certain executives and employees of, and other individuals affiliated with, New Mountain in a separate private placement at the initial public offering price per share. New Mountain Finance will receive the full proceeds of approximately $29,865,000, assuming an initial public offering price of $14.50 per share (the mid-point of the range set forth on the cover of this prospectus), from the sale of these shares, and no underwriting discounts or commissions will be paid in respect of these shares. |

|

Common Stock to be Outstanding After this Offering and Concurrent Private Placement |

11,597,791 shares (including 3,312,619 shares purchased in the concurrent private placement and shares New Mountain Guardian Partners, L.P. will receive in connection with this offering), excluding 1,242,776 shares of common stock issuable pursuant to the option to purchase additional shares granted to the underwriters. |

|

Common Membership Units of the Operating Company to be Outstanding After this Offering and Concurrent Private Placement |

31,819,729 common membership units (33,062,505 common membership units if the option to purchase additional shares granted to the underwriters is exercised in full). Guardian AIV, indirectly through AIV Holdings, will hold 20,221,938 common membership units immediately after this offering. |

|

Exchange Right |

AIV Holdings, which is wholly-owned by Guardian AIV, will have the right to exchange all or any portion of its common membership units of the Operating Company for shares of New Mountain Finance's common stock on a one-for-one basis. If, following the completion of the transactions described in this prospectus, AIV Holdings exercised its right to exchange its common membership units of the Operating Company, Guardian AIV, indirectly through AIV Holdings, would own approximately 63.6% of all outstanding shares of New Mountain Finance's common stock (or 61.2% if the option to purchase additional shares granted to the underwriters was exercised in full). In addition, if exemptive relief is granted from the SEC to permit the Operating Company to pay 50%, on an after tax basis, of the incentive fee in common membership units of the Operating Company, the Investment Adviser will also have the right to exchange all or any portion of its common membership units so received for shares of New Mountain Finance's common stock. |

|

|

16

Use of Proceeds |

We estimate that New Mountain Finance will receive proceeds from the sale of common stock in this offering and the concurrent private placement of approximately $150.0 million, or approximately $168.0 million if the underwriters exercise their option to purchase additional shares in full, in each case assuming an initial public offering price of $14.50 per share (the mid-point of the range set forth on the cover of this prospectus). New Mountain Finance will use all of the proceeds from this offering as well as the proceeds from the concurrent private placement, to acquire from the Operating Company a number of common membership units equal to the number of shares of New Mountain Finance's common stock sold in this offering and in the concurrent private placement at a price per unit equal to the public offering price per share. The Operating Company, in turn, will use a portion of these proceeds to pay the underwriting discounts and commissions and estimated expenses of this offering, and intends to use the remaining net proceeds for new investments in portfolio companies in accordance with our investment objective and strategies described in this prospectus, to temporarily repay indebtedness (which will be subject to reborrowing), to pay New Mountain Finance's and its operating expenses and distributions to its members and for general corporate purposes. Pending such use, the Operating Company will invest the net proceeds primarily in cash, cash equivalents, U.S. government securities and other high-quality investments that mature in one year or less from the date of the investment. See "Use of Proceeds". |

|

NYSE Symbol |

"NMFC" |

|

Investment Advisory Fees |

New Mountain Finance will not have an investment adviser. The Operating Company will pay the Investment Adviser a fee for its services under the Investment Management Agreement consisting of two components — a base management fee and an incentive fee. The base management fee is payable quarterly in arrears and is calculated at an annual rate of 1.75% of the Operating Company's gross assets less (i) the borrowings under the SLF Credit Facility and (ii) cash and cash equivalents. The incentive fee consists of two parts. The first part is calculated and payable quarterly in arrears and equals 20% of the Operating Company's "pre-incentive fee adjusted net investment income" for the immediately preceding quarter, subject to a preferred return, or "hurdle", and a "catch-up" feature. The second part will be determined and payable in arrears as of the end of each calendar year (or upon termination of the Investment Management Agreement) and will equal 20% of the Operating Company's adjusted realized capital gains, if any, on a cumulative basis from inception through the end of the year, computed net of all adjusted realized capital losses |

|

|

17

|

and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fee. New Mountain Finance and the Operating Company intend to seek exemptive relief from the SEC to permit the Operating Company to pay 50%, on an after tax basis, of the incentive fee in common membership units of the Operating Company having a total market price, calculated based on the market price of New Mountain Finance's common stock, equal to the amount of the incentive fee, which common membership units will be exchangeable into shares of New Mountain Finance's common stock on a one-for-one basis. There can be no assurance that this exemptive relief will be granted. If exemptive relief is not granted, the Operating Company will pay the entire incentive fee in cash. See "Investment Management Agreement". |

|

Administrator |

The Administrator serves as the administrator for New Mountain Finance and the Operating Company and arranges office space for us and provides us with office equipment and administrative services. The Administrator also oversees our financial records, prepares reports to New Mountain Finance's stockholders and the Operating Company's members and reports filed by us with the SEC, and generally monitors the payment of our expenses and the performance of administrative and professional services rendered to us by others. The Operating Company will reimburse the Administrator for New Mountain Finance's and the Operating Company's allocable portion of overhead and other expenses incurred by the Administrator in performing its obligations to New Mountain Finance and the Operating Company under the Administration Agreement. See "Administration Agreement". |

|

Lock-up Agreement |

New Mountain Finance, each of its officers and directors, New Mountain Guardian Partners, L.P. (and its transferees), and each of the members of our Investment Adviser's investment committee have agreed with the underwriters, subject to certain exceptions, not to dispose of or hedge any shares of New Mountain Finance's common stock or securities convertible into or exchangeable for shares of New Mountain Finance's common stock during the period from the date of this prospectus continuing through the date 180 days after the date of this prospectus, except with the prior written consent of Goldman, Sachs & Co., Wells Fargo Securities, LLC and Morgan Stanley & Co. Incorporated. AIV Holdings has also entered into a similar lock-up agreement that prevents the exchange of its common membership units of the Operating Company for up to 180 days after the date of this prospectus, subject to carve outs and an extension in certain circumstances. In addition, if New Mountain Finance and the Operating Company receive exemptive relief from the SEC to permit us to pay 50%, on an after tax basis, of the incentive fee in common membership units of the Operating Company, any |

|

|

18

|

common membership units so received by the Investment Adviser will be subject to a 3-year lock-up agreement, pursuant to which, one-third of the common membership units received by the Investment Adviser will be released from the lock-up on an annual basis until the expiration of each 3-year lock-up period. See "Underwriting" and "Shares Eligible for Future Sale" for a discussion of certain transfer restrictions. |

|

Distributions |

New Mountain Finance intends to pay quarterly distributions to its stockholders out of assets legally available for distribution, beginning with the first full quarter after the completion of this offering. The quarterly distributions, if any, will be determined by New Mountain Finance's board of directors. The distributions New Mountain Finance pays to its stockholders in a year may exceed its taxable income for that year and, accordingly, a portion of such distributions may constitute a return of capital for federal income tax purposes. The specific tax characteristics of New Mountain Finance's distributions will be reported to stockholders after the end of the calendar year. The Operating Company intends to make distributions to its members that will be sufficient to enable New Mountain Finance to pay quarterly distributions to its stockholders. See "Distributions". |

|

Taxation of New Mountain Finance |

New Mountain Finance intends to elect to be treated, and intends to qualify annually, as a RIC under Subchapter M of the Code, commencing with its taxable year ending on December 31, 2011. As a RIC, New Mountain Finance generally will not pay corporate-level federal income taxes on any net ordinary income or capital gains that it timely distributes to its stockholders as dividends. To obtain and maintain its RIC status, New Mountain Finance must meet specified source-of-income and asset diversification requirements and distribute annually to its stockholders at least 90% of its net ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. The Operating Company intends to make distributions to its members that will be sufficient to enable New Mountain Finance to obtain and maintain its status as a RIC. See "Distributions" and "Material Federal Income Tax Considerations". |

|

Taxation of Operating Company |

The Operating Company expects to be treated as a partnership for federal income tax purposes for as long as it has at least two members. As a result, the Operating Company will itself not be subject to federal income tax. Rather, each of the Operating Company's members, including New Mountain Finance, will be required to take into account, for federal income tax purposes, its allocable share of the Operating Company's items of income, gain, loss, deduction and credit. SLF expects to be treated as a disregarded entity for federal income tax purposes. As a result, SLF will itself not be subject to federal income tax and, for federal income tax purposes, the Operating Company will take into account all of SLF's assets and items of income, gain, loss, deduction and credit. See "Material Federal Income Tax Considerations". |

|

|

19

Dividend Reinvestment Plan |

New Mountain Finance has adopted an "opt out" dividend reinvestment plan for its stockholders. As a result, if New Mountain Finance declares a distribution, then your cash distributions will be automatically reinvested in additional shares of New Mountain Finance's common stock, unless you specifically "opt out" of the dividend reinvestment plan so as to receive cash distributions. Stockholders who receive distributions in the form of stock will be subject to the same federal income tax consequences as stockholders who elect to receive their distributions in cash. Cash distributions reinvested in additional shares of New Mountain Finance's common stock will be automatically reinvested by New Mountain Finance in additional common membership units of the Operating Company. New Mountain Finance will use only newly issued shares to implement the plan if the price at which newly-issued shares are to be credited is equal to or greater than 110% of the last determined net asset value of the shares. New Mountain Finance reserves the right to purchase shares of its common stock in the open market in connection with its implementation of the plan if the price at which its newly-issued shares are to be credited does not exceed 110% of the last determined net asset value of the shares. See "Dividend Reinvestment Plan". |

|

Trading at a Discount |

Shares of closed-end investment companies frequently trade at a discount to their net asset value. The possibility that New Mountain Finance's common stock may trade at a discount to its net asset value per share is separate and distinct from the risk that its net asset value per share may decline. New Mountain Finance cannot predict whether its common stock will trade above, at or below net asset value. |

|

License Agreement |

New Mountain Finance and the Operating Company have entered into a royalty-free license agreement with New Mountain, pursuant to which New Mountain has agreed to grant New Mountain Finance and the Operating Company a non-exclusive license to use the name "New Mountain". See "License Agreement". |

|

Leverage |

We expect that the Operating Company will continue to use leverage to make investments. As a result, we may continue to be exposed to the risks of leverage, which include that leverage may be considered a speculative investment technique. The use of leverage magnifies the potential for gain and loss on amounts invested by the Operating Company and therefore, indirectly, increases the risks associated with investing in shares of New Mountain Finance's common stock. See "Risk Factors". |

|

Anti-Takeover Provisions |

New Mountain Finance's and the Operating Company's respective boards of directors are divided into three classes of directors serving staggered three-year terms. This structure is intended to provide us with a greater likelihood of continuity of management, which may be necessary for us to realize the full value of our investments. A staggered |

|

|

20

|

board of directors also may serve to deter hostile takeovers or proxy contests, as may certain other measures that we may adopt. These measures may delay, defer or prevent a transaction or a change in control that might otherwise be in the best interests of New Mountain Finance stockholders. See "Description of New Mountain Finance's Capital Stock — Delaware Law and Certain Certificate of Incorporation and Bylaw Provisions; Anti-Takeover Measures". |

|

Available Information |

After completion of this offering, New Mountain Finance will be required to file periodic reports, current reports, proxy statements and other information with the SEC. Unless and until exemptive relief is granted from the SEC, the Operating Company will also be required to file similar reports with the SEC. This information will be available at the SEC's public reference room at 100 F Street, NE, Washington, D.C. 20549 and on the SEC's website at http://www.sec.gov. The public may obtain information on the operation of the SEC's public reference room by calling the SEC at 202-551-8090. This information will also be available free of charge by contacting us at New Mountain Finance Corporation, 787 7th Avenue, 48th Floor, New York, NY 10019, by telephone at (212) 720-0300, or on our website at http://www.newmountainfinancecorp.com. The information on our website is not incorporated by reference into this prospectus. |

Unless otherwise indicated, all information in this prospectus reflects the consummation of the formation transactions described in "Formation Transactions and Related Agreements" and the concurrent private placement.

A nominal amount of shares of New Mountain Finance's common stock was outstanding prior to the completion of this offering. The number of shares of New Mountain Finance's common stock to be outstanding after completion of this offering is based on 10,344,827 shares of New Mountain Finance's common stock to be sold in this offering and the concurrent private placement and 1,252,964 shares of New Mountain Finance's common stock to be received by Guardian Partners in the formation transactions, and except where we state otherwise, the common stock information presented in this prospectus:

21

The following table is intended to assist you in understanding the costs and expenses that an investor in this offering will bear directly or indirectly. We caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus contains a reference to fees or expenses paid by "you", "New Mountain Finance", the "Operating Company", or "us" or that "we", "New Mountain Finance", or the "Operating Company" will pay fees or expenses, stockholders will indirectly bear such fees or expenses through New Mountain Finance's investment in the Operating Company.

Stockholder transaction expenses: |

||||

Sales load (as a percentage of offering price) |

7.00 | %(1) | ||

Offering expenses (as a percentage of offering price) |

4.39 | %(2) | ||

Dividend reinvestment plan fees |

— | (3) | ||

Total stockholder transaction expenses (as a percentage of offering price) |

11.39 | % | ||

Annual expenses (as a percentage of net assets attributable to common stock(4)): |

||||

Base management fees |

2.45 | %(5) | ||

Incentive fees payable under Investment Management Agreement |

— | %(6) | ||

Interest payments on borrowed funds |

0.89 | %(7) | ||

Other expenses (estimated) |

1.19 | %(8) | ||

Total annual expenses |

4.53 | %(9) | ||

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in New Mountain Finance's common stock. In calculating the following expense amounts, we have assumed that the Operating Company's borrowings and annual expenses would remain at the levels set forth in the table above and assumed that you would pay a sales load of 7.00% (the underwriting discount and commission to be paid by the Operating Company with respect to common stock sold by New Mountain Finance in this offering).

| |

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

You would pay the following expenses on a $1,000 investment, assuming a 5% annual return |

$ | 42 | $ | 127 | $ | 212 | $ | 426 | |||||

22

range set forth on the front cover of this prospectus), less the sales load and offering expenses.

The second part of the incentive fee will equal 20% of our "Incentive Fee Capital Gains", which will equal the Operating Company's realized capital gains on a cumulative basis from inception through the end of the year, if any, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees. The second part of the incentive fee will be payable, in arrears, at the end of each calendar year (or upon termination of the Investment Management Agreement, as of the termination date), commencing with the year ending December 31, 2011. New Mountain Finance and the Operating Company intend to seek exemptive relief from the SEC to permit the Operating Company to pay 50%, on an after tax basis, of the incentive fee in common membership units of the Operating Company having a total market price, calculated based on the market price of New Mountain Finance's common stock, equal to the amount of the incentive fee, which common membership units will be exchangeable into shares of New Mountain Finance's common stock on a one-for-one basis. There can be no assurance that this exemptive relief will be granted. If exemptive relief is not granted, the Operating Company will pay the entire incentive fee in cash.

23

The example and the expenses in the tables above should not be considered a representation of future expenses, and actual expenses may be greater or less than those shown. While the example assumes, as required by the applicable rules of the SEC, a 5% annual return, our performance will vary and may result in a return greater or less than 5%. The incentive fee under the Investment Management Agreement, which, assuming a 5% annual return, would either not be payable or would have an insignificant impact on the expense amounts shown above, is not included in the example. If the Operating Company achieves sufficient returns on our investments, including through the realization of capital gains, to trigger an incentive fee of a material amount, its expenses, and returns to New Mountain Finance investors, would be higher. In addition, while the example assumes reinvestment of all distributions at net asset value, participants in New Mountain Finance's dividend reinvestment plan will receive a number of shares of New Mountain Finance's common stock, determined by dividing the total dollar amount of the distribution payable to a participant by the market price per share of New Mountain Finance's common stock at the close of trading on the dividend payment date fixed by New Mountain Finance's board of directors, which may be at, above or below net asset value. See "Dividend Reinvestment Plan" for additional information regarding the dividend reinvestment plan.

24

SELECTED FINANCIAL AND OTHER DATA

The selected combined financial and other data below reflects the combined historical operations of New Mountain Finance Holdings, L.L.C., formerly known as New Mountain Guardian (Leveraged), L.L.C., and New Mountain Guardian Partners, L.P., the assets of which will be contributed to the Operating Company in connection with the formation transactions. This combined financial and other data is the Operating Company's historical financial and other data. The Operating Company will be New Mountain Finance's sole investment following the completion of this offering. To date, New Mountain Finance Corporation has had no operations. As described in "Formation Transactions and Related Agreements — Holding Company Structure", following the completion of this offering, New Mountain Finance will be a holding company with no direct operations of its own, and its only business and sole asset will be its ownership of common membership units of the Operating Company.

We have derived the selected historical balance sheet information as of December 31, 2008, 2009 and 2010 and the selected statement of operations information for the period from October 29, 2008 (inception) through December 31, 2008 and for the years ended December 31, 2009 and 2010 from the Operating Company's audited combined financial statements included elsewhere in this prospectus.

The historical financial information does not reflect the allocation of certain general and administrative costs or other expenses or the impact of management fees that were incurred by affiliates of New Mountain. We expect that, following the completion of this offering, our share of expenses and management fees as a stand-alone company will be higher than those historically incurred by the Operating Company. Accordingly, the historical financial information should not be relied upon as being representative of our financial position or operating results had we operated on a stand-alone basis under similar regulatory constraints, nor are they representative of our financial position or operating results following this offering. In addition, following the completion of this offering, New Mountain Finance will own approximately 36.4% of the common membership units of the Operating Company, assuming no exercise of the underwriters' option to purchase additional shares. Depending on New Mountain Finance's ownership interest in the Operating Company, the Operating Company's results of operations may not be consolidated with New Mountain Finance's results of operations in future periods. As a result, the historical and future financial information may not be representative of New Mountain Finance's financial information in future periods.

The financial and other information below should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations", "Senior Securities" and

25

the Operating Company's combined financial statements and related notes, which are included elsewhere in this prospectus.

| |

Year ended December 31, 2010 |

Year ended December 31, 2009 |

Period from October 29, 2008 (inception) through December 31, 2008 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(dollars in thousands) |

|||||||||

Income statement data: |

||||||||||

Total investment income |

$ | 41,375 | $ | 21,767 | $ | 256 | ||||

Total expenses |

3,911 | 1,359 | — | |||||||

Net investment income |

37,464 | 20,408 | 256 | |||||||

Realized gains on investments |

$ | 66,287 | $ | 37,129 | — | |||||

Net change in unrealized (depreciation) / appreciation of investments |

(39,959 | ) | 68,143 | (1,435 | ) | |||||

Net increase (decrease) in net assets resulting from operations |

$ | 63,792 | $ | 125,680 | $ | (1,179 | ) | |||

Other data: |

||||||||||

Weighted average Yield to Maturity(1) |

12.5 | % | 12.7 | % | 18.8 | % | ||||

Number of portfolio companies at period end |

43 | 24 | 6 | |||||||

Balance sheet data: |

||||||||||

Total investments at fair value |

$ | 441,058 | $ | 320,523 | $ | 61,451 | ||||

Total cash and cash equivalents |

10,744 | 4,110 | 189 | |||||||

Total assets |

460,224 | 330,558 | 61,669 | |||||||

Borrowings outstanding |

116,633 | 77,745 | — | |||||||

Net assets |

241,927 | 239,441 | 30,354 | |||||||

26

Investing in New Mountain Finance's common stock involves a number of significant risks. In addition to the other information contained in this prospectus, you should consider carefully the following information before making an investment in New Mountain Finance's common stock. The risks set out below are not the only risks we face. Additional risks and uncertainties not presently known to us or not presently deemed material by us might also impair our operations and performance. If any of the following events occur, our business, financial condition and results of operations could be materially and adversely affected. In such case, our net asset value and the trading price of New Mountain Finance's common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

We have a limited operating history.

New Mountain Finance is a newly-formed entity and the Operating Company commenced operations in October 2008. Prior to the completion of this offering, the Operating Company will own all of the operations of the Predecessor Entities existing immediately prior to the formation transactions, including all of the assets and liabilities related to such operations. New Mountain Finance will be a holding company with no direct operations of its own, and its only business and sole asset will be its ownership of common membership units of the Operating Company. As a result, we will be subject to many of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our investment objective and that, as a result, the value of New Mountain Finance's common stock could decline substantially.

We do not expect to replicate the Predecessor Entities' historical performance or the historical performance of other entities managed or supported by New Mountain.

We do not expect that we will replicate the Predecessor Entities' historical performance or the historical performance of New Mountain's investments, and our investment returns may be substantially lower than the returns achieved by the Predecessor Entities. Although the Predecessor Entities commenced operations during otherwise unfavorable economic conditions, this was a favorable environment in which to conduct our business in light of our investment objectives and strategy. In addition, our investment strategies may differ from those of New Mountain or its affiliates. New Mountain Finance and the Operating Company, as business development companies, and New Mountain Finance, as a RIC, and the Operating Company as a result of New Mountain Finance being a RIC, are subject to certain regulatory restrictions that do not apply to New Mountain or its affiliates.

The Operating Company will generally not be permitted to invest in any private company in which New Mountain or any of its affiliates holds an existing investment, except to the extent permitted by the 1940 Act. This may adversely affect the pace at which the Operating Company makes investments. Moreover, we expect the Operating Company will operate with a different leverage profile than the Predecessor Entities. Furthermore, none of the prior results were from public reporting companies, and all or a portion of these results were achieved in particularly favorable market conditions for our investment strategy which may never be repeated. Finally, we can offer no assurance that our investment team will be able to continue to implement our investment objective with the same degree of success as it has had in the past.

27

There will be uncertainty as to the value of our portfolio investments because most of our investments are, and will continue to be in private companies and recorded at fair value. In addition, because New Mountain Finance will be a holding company, the fair value of our investments will be initially determined by the Operating Company's board of directors in accordance with our valuation policy.

Some of our investments are and will be in the form of securities or loans that are not publicly traded. The fair value of these investments may not be readily determinable. Under the 1940 Act, the Operating Company is required to carry our portfolio investments at market value or, if there is no readily available market value, at fair value as determined in good faith by its board of directors, including to reflect significant events affecting the value of our securities. The Operating Company will value our investments for which it does not have readily available market quotations quarterly, or more frequently as circumstances require, at fair value as determined in good faith by its board of directors in accordance with its valuation policy, which is at all times consistent with generally accepted accounting principles.

The Operating Company's board of directors expects to utilize the services of one or more independent third-party valuation firms to aid it in determining the fair value with respect to its material unquoted assets. We expect that inputs into the determination of fair value of these investments may require significant management judgment or estimation. Even if observable market data are available, such information may be the result of consensus pricing information or broker quotes, which include a disclaimer that the broker would not be held to such a price in an actual transaction. The non-binding nature of consensus pricing and/or quotes accompanied by disclaimers materially reduces the reliability of such information.

The types of factors that the board of directors may take into account in determining the fair value of our investments generally include, as appropriate: available market data, including relevant and applicable market trading and transaction comparables, applicable market yields and multiples, security covenants, call protection provisions, information rights, the nature and realizable value of any collateral, the portfolio company's ability to make payments, its earnings and discounted cash flows and the markets in which it does business, comparisons of financial ratios of peer companies that are public, comparable merger and acquisition transactions and the principal market and enterprise values. Because these valuations, and particularly valuations of private securities and private companies, are inherently uncertain, may fluctuate over short periods of time and may be based on estimates, the Operating Company's determinations of fair value may differ materially from the values that would have been used if a ready market for these securities existed.

Due to this uncertainty, the Operating Company's fair value determinations may cause its net asset value and, consequently, New Mountain Finance's net asset value on any given date to materially understate or overstate the value that the Operating Company may ultimately realize upon the sale of one or more of our investments. In addition, investors purchasing New Mountain Finance's common stock based on an overstated net asset value would pay a higher price than the realizable value of our investments might warrant. Because New Mountain Finance will be a holding company and its only business and sole asset will be its ownership of common membership units of the Operating Company, New Mountain Finance's net asset value will be based on the Operating Company's valuation and its percentage interest in the Operating Company.

Although the Operating Company's initial board of directors will be comprised of the same individuals as New Mountain Finance's board of directors, there can be no assurances that the Operating Company's board composition will remain the same as New Mountain Finance's following the completion of this offering. As a result, the value of your investment in New Mountain Finance could be similarly understated or overstated based on the Operating Company's fair value determinations. However, in the event that New Mountain Finance's board of directors believes that

28

a different fair value for the Operating Company's investments is appropriate, New Mountain Finance's board of directors will endeavor to discuss the differences in the valuations with the Operating Company's board of directors for the purposes of resolving the differences in valuation. The valuation procedures of New Mountain Finance will be substantially similar to those utilized by the Operating Company described above.

The Operating Company will adjust quarterly the valuation of our portfolio to reflect its board of directors' determination of the fair value of each investment in our portfolio. Any changes in fair value will be recorded in the Operating Company's statement of operations as net change in unrealized appreciation or depreciation.

Our ability to achieve our investment objective depends on key investment personnel of the Investment Adviser. If the Investment Adviser were to lose any of its key investment personnel, our ability to achieve our investment objective could be significantly harmed.